The impact of Covid-19 on Regulatory Reporting for PRA supervised-firms

Covid-19 Regulatory Reporting PRA Supervised-Firms

In these challenging times, the reliability of regulatory returns has become even more critical for the PRA. However, as part of its response to Covid-19, the PRA has taken a pragmatic approach to its supervisory work. It has paused the Skilled Persons Section 166 reviews that were announced in October 2019 and postponed some deadlines, where appropriate.

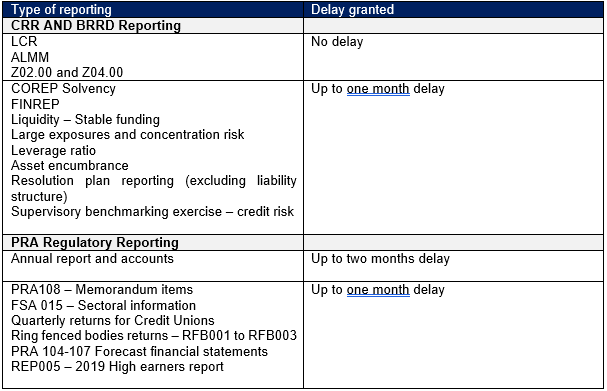

In a Statement on ‘Covid-19 regulatory reporting and disclosure amendments’ issued on 9 April 2020, the PRA gave firms some leeway with regard to the remittance dates for some areas of supervisory reporting, which are not crucial to monitoring firms’ financial and prudential situation.

Where the original remittance deadlines fall on or before 31 May 2020, the following applies:

The PRA’s Business Plan for 2020-2021 outlines what it expects firms to do, once on-site visits and reviews resume. They expect them to:

- Review their policies, procedures and processes around regulatory returns, establishing the extent to which they are fit for purpose and how effectively they are applied in practice

- Demonstrate how the design and operation of the governance, control and other processes deliver regulatory reporting of appropriate quality

- Review how data is captured, cleaned and represented within their regulatory reports

- Provide details of the key interpretations and judgments made related to regulatory returns and the governance processes used to validate these

- Provide details of any identified material regulatory reporting errors, along with an explanation of the actions taken to remediate these issues

- Assess their existing capabilities

A reminder of regulatory expectations prior to Covid-19

On 31 October 2019, Sarah Breeden and David Bailey, PRA Executive Directors at the UK Deposit Takers Supervision and International Banks Supervision respectively, issued a Dear CEO Letter to PRA-supervised banks and building societies. They reinforced that firms are expected to submit complete, timely and accurate regulatory returns. They referred to the recommendation included in the Independent Review of the Prudential Supervision of The Co-operative Bank Plc published on 27 March 2019 saying; the PRA may consider introducing more formal third-party reviews of key prudential information supplied by firms in their regulatory reporting.

They expressed the intention for the PRA to commission reports from Skilled Persons (Section 166 of FMSA Act 2000) focusing on the Common Reporting (COREP) framework and newly introduced returns such as the PRA110 Cashflow mismatch template.

The importance placed by the regulators on the accuracy of returns and their willingness to take enforcement action was again emphasised on 26 November 2019, when the PRA issued a Decision Notice with regard to various UK entities of Citi and imposed a financial penalty of £43.9 million for failings in their regulatory reporting governance and controls. The PRA found that the firms’ regulatory reporting framework in the UK was not “designed, implemented or operating effectively”. As a result, returns were found to be inaccurate and the PRA could not rely on the information supplied to adequately perform its supervisory duties.

The PRA continues to encourage firms to seek third party assurance over their regulatory reporting processes, which can include assessment and benchmarking over COREP capabilities, in addition to bespoke reviews.

For more information on how to meet the PRA’s regulatory reporting expectations, please get in touch.

Key Contact