In a world that is becoming more lopsided, where political acrimony rather than business logic increasingly drives decisions, this is not a bad way to think about investment risk.

It has been an eventful month. Surviving an assassination attempt emboldened the Republican Presidential nominee to pick an isolationist VP candidate, attack the Federal Reserve and cause a sharp reversal in the tech trade, by ostensibly rethinking the long-term American dogma of protecting Taiwan, thus sparking a rout in global tech.

Meanwhile, a global IT outage caused massive problems, after CrowdStrike, a popular software provider, bungled an update and affected many Windows operating systems around the world. Contemplating how vulnerable global infrastructure is, I found myself laughing remembering the old meme, where a very complex world relies on Microsoft Excel.

The business world, be it investments, the economy, or the day-to-day running of a business, is based on some kind of predictability. One starts a business because one can credibly project some profits. How else would they risk their own capital or convince someone to invest with them? How can they get employees to join, suppliers to trust their cheques and so on? Investments work pretty much the same way. Whereas short-term investment returns are even more unpredictable than business cashflows (due to sentiment, the macro economy, interest rates, or just random market movements), we can still approximately predict some elements, especially over the long term.

A volatile world favours fringe outcomes, so-called tail-risks (because they are at the ‘tail’ of the distribution). We know from experience that the more we veer towards the tail, especially the negative end, the more outcomes become unpredictable.

It’s even worse for policymakers, especially elected officials. It’s very easy to keep borrowing to support growth, but to do that with any hope that you won’t end up with default or high inflation (which can be analogous to a form of default), you need to keep interest payments in check, and growth relatively high. To do that, you need to be able to project growth (more difficult in open economies) and interest rates (which depend on an independent central bank and an unpredictable global environment).

But in the last few years the pandemic catalysed a faster rate of global geoeconomic fragmentation and, up to a point, deglobalisation.

It’s easy to speak of such things in theory, but let’s look at the practical problems. In the previous few weeks, we had been trying to find out what could stop Nvidia from climbing, given its monopoly on global high-end chips. We suggested a government breakup, or demand far outstripping supply leading to shortages. A US presidential candidate reconsidering Taiwan’s protected status wasn’t on the list. But this is the nature of our increasingly lopsided world. Nvidia is down -16% from its recent highs, at the time of writing. And no matter the number of endorsements to one candidate or another, Silicon Valley is very afraid of fractured global supply chains.

Let’s take another example. Labour’s landslide victory made some market analysts think that growth could come from renewing trade ties with Europe. Brexit can’t be undone of course, but reducing hostility with 2/3rds of Britain’s trade is the lowest-hanging fruit in delivering growth. Let us assume that Mr Starmer, who now commands a very wide margin in Parliament, decided to do just that. Who would he call? If he called France, he’d be met with a procedural prime minister and no government. If he called Germany, any negotiations with a shaky coalition government would be likely to be reviewed by the next government, as the three ruling parties have lost many votes in the recent European elections. And even if he could find some foothold, renewed trade talks would still be at the mercy of Hungary’s Presidency of the EU or a long period before the new EU commissioners get to work. For trade deals to go through, a period of stability between both signing parties is required. In an unstable world, existing trade ties become more stressed and forging new ones becomes more difficult. A world like that changes from Ricardian principles (“Trade benefits everyone”) to mercantilist principles (“exports must be higher than imports or there’s no point to trade”), the latter being more competitive and allowing bigger players to increase their advantage.

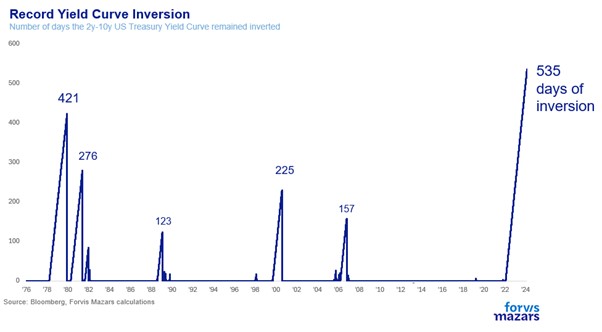

Yet another example would be the yield curve inversion. The US 2y-10y yield curve has been inverted for a record 2 years.

In the past few weeks, the Fed had indicated that the time for rate cuts is drawing closer, pushing the yield curve up towards the threshold of positivity. Then, Mr Trump warned the Fed not to cut rates before the election and said that he would consider “letting” Mr Powell finish out his term as long as his decisions were agreeable. The immediate reaction was a drop in rate cut expectations. But the potential damage of politicising the central bank of the world’s reserve currency is much more significant. We have long argued that trade wars in a mercantilist world would see central bank independence compromised, leading to higher inflation and macroeconomic instability. Governors who will want to get on board with government policy will do more to keep the cost of money low, and possibly inflation higher.

The point we are driving at is that in a lopsided world, risk is becoming increasingly non-linear. This makes fringe outcomes more common, and investing less predictable.

Look at the so-called ‘Sigmoid’ or ‘Step’ risks. In essence, these are risks that don’t appear as large probability events but can escalate very quickly, not giving investors a chance to protect against them. In a lopsided world, where risks can be driven by politics, such events can conceivably become more common.

How to invest in a lopsided world

The first thing we have to do is acknowledge that the scenario of a heavily lopsided world is not a foregone conclusion. Even if it comes to pass, it might not do so in its entirety and immediately, but fractionally and in a more paced way. We believe that the outcome of the next US presidential election will be a milestone either way, but generally acknowledge that the US body politic as a whole has somewhat strayed from the mainstream and demands more forceful solutions from both sides of the aisle. This will have an impact on shaping the new political and economic balances in the world.

The second acknowledgement is that the nature of the change is generational. From the fall of the Soviet Union in 1991 to 2016, the world moved towards globalisation. The next decade, which the IMF calls “slow-balisation”, was a period where trade had reached some 55% of global GDP, so natural political limits to further trade expansion emerged. From one perspective, we are just talking about ‘normalisation’. Going back to a world where inflation is possible and where the central bank ‘Put’ does not underwrite all investment decisions. But that world, before globalisation and before QE is way back.

Anyone who wasn’t investing money during the Cold War does not remember a period of high inflation, strong trade antagonism and political threats that gave rise to systemic risks. And those who did, did so in a far less indebted and interconnected world. For most investors under 55, who lived through globalisation, the Great Moderation, Quantitative Easing and Zero Interest Rate Policies (ZIRP), the world we are entering is relatively new. We can theoretically understand it, but we should be prepared for reality to be different from our calculations. In other words, accept this is a world that is out of the cradle of quantitative easing, and where long-supressed risks might spring up. There are more things we now actively worry about than we were in previous years.

What investment strategies might be adopted in this ‘lopsided world’?

Again, acknowledging what we don’t know, here are some examples:

- Higher volatility will mean also more and bigger investment opportunities, as risk premiums for holding assets will logically be higher. So the first question any investor or organisation should ask, after a decade of QE is: are we set up to acknowledge and invest in those opportunities? Also, the market might give more time to enter a particular investment. The higher the number of opportunities, the longer the period one may have to understand and undertake an investment bet.

- Smaller and more ‘bets’, low leverage, and bigger risk bands. Higher risk premiums mean not just the opportunity for higher returns, but also higher risk, especially of the systemic ilk (i.e. risk one can’t diversify away). Bets will probably have to be taken with a lower conviction than previously, as systemic risks would be structurally higher. That means that while there are more opportunities, there will also be higher volatility. Investors should not just focus on the payout but also on those risks. This would mean taking smaller exposure to individual bets (and taking more of them, especially if they are decorrelated in stress periods) and maintaining low leverage.

- Understanding the importance of Strategic Asset Allocation. The world we are describing will be a more ‘noisy’ one, with plenty of false signals either way. More and smaller tactical bets are certainly an engine for ‘alpha’, but it is getting the long view right that will make a big difference between the successful and the not-so-successful asset managers.

George Lagarias – Chief Economist

Market update

| UK Stock | US Stocks | EU Stocks | Global Stocks | EM Stocks | Japan Stocks | Gilts | GBP/USD |

| +1.6% | -0.5% | +0.8% | -0.3% | -1.1% | -3.3% | +0.1% | -0.4% |

Large cap US stocks fell once again this week as technology and AI companies sold off. The earnings reports of Tesla and Google affected sentiment midweek as investors appeared to raise doubts over the ability of tech firms to convert the vast amount of spending on AI progress into tangible earnings. Small cap stocks outperformed large cap stocks over the week, while value outperformed growth. In all, US stocks were down by -0.5%.

Stocks globally were down by -0.3%. Japan was a particular point of weakness, falling -3.3%, as the Yen strengthened, hurting the outlook of exporters. The UK and EU made positive returns however, thanks to strong earnings and more favourable political developments.

Bond yields fell modestly, with declines of -5, -2, and -6 basis points seen in the yields of 10-year US, UK and German bonds respectively. US Treasuries reacted positively to the release of Core PCE (the Federal Reserve’s preferred inflation measure), which increased by 0.2% in June, broadly in line with expectations.

Gold fell by -0.3% while oil fell by -3.2%.

Macro news

The US Commerce Department’s released its core (less food and energy) personal consumption expenditures (PCE) price index, which rose a tick more than expected (0.2%) in June but stayed steady at an annual rate of 2.6% - not too far above the 2.0% target for the Federal Reserve’s preferred inflation gauge. The inflation data appeared to cement expectations for a Fed rate cut at its September meeting.

A string of rate cuts by the People’s Bank of China (PBOC) pointed to the growing urgency to support growth after China’s GDP undershot expectations in the second quarter. The PBOC cut its medium-term lending facility by 20 basis points to 2.3%, its first reduction since August 2023. The central bank also reduced its seven-day reverse repo rate, a key short-term policy rate, by 10 basis points to 1.7%. Shortly afterwards, Chinese banks cut their one- and five-year loan prime rates by 10 basis points to 3.35% and 3.85%, respectively, making it cheaper for consumers to take out mortgages and other loans.

The US economy grew at a rate of 2.8% (annualised) in the second quarter of 2024, surpassing the consensus estimate of 2.0%. The stronger than expected figure was driven in part by robust consumer spending, which increased at a rate of 2.3% over the quarter (versus 2.0% expected) due to a rebound in spending on durable goods. Inventory investment, and non-residential fixed investment also drove growth in the second quarter. Interest rate futures markets are currently pricing in two rate cuts by the Federal Reserve before the end of the year and expect the first cut to come in late September.

The week ahead

It’s a big, consequential week for markets globally as two major themes come together — central banks and US technology stocks.

The Bank of Japan, the US Federal Reserve and the Bank of England will release their interest rate decisions this week. The first might hike, the latter pair might at least guide to when they’ll start reducing rates.

There will also be earnings released from Microsoft, Meta, Amazon and Apple. Combined, that’s roughly $10 trillion in market value reporting over three days, and markets will be keen to gauge the future prospects of AI.