Monthly insolvency statistics – July 2023

Monthly insolvency statistics – July 2023

Corporate Insolvencies

England and Wales

Corporate insolvencies in July 2023 were 6% lower than July 2022 but 18% higher than July 2019.

Creditors Voluntary Liquidations (“CVLs”) totalled 1,336, 17% lower than July 2022 and 33% higher than in (pre-pandemic) July 2019.

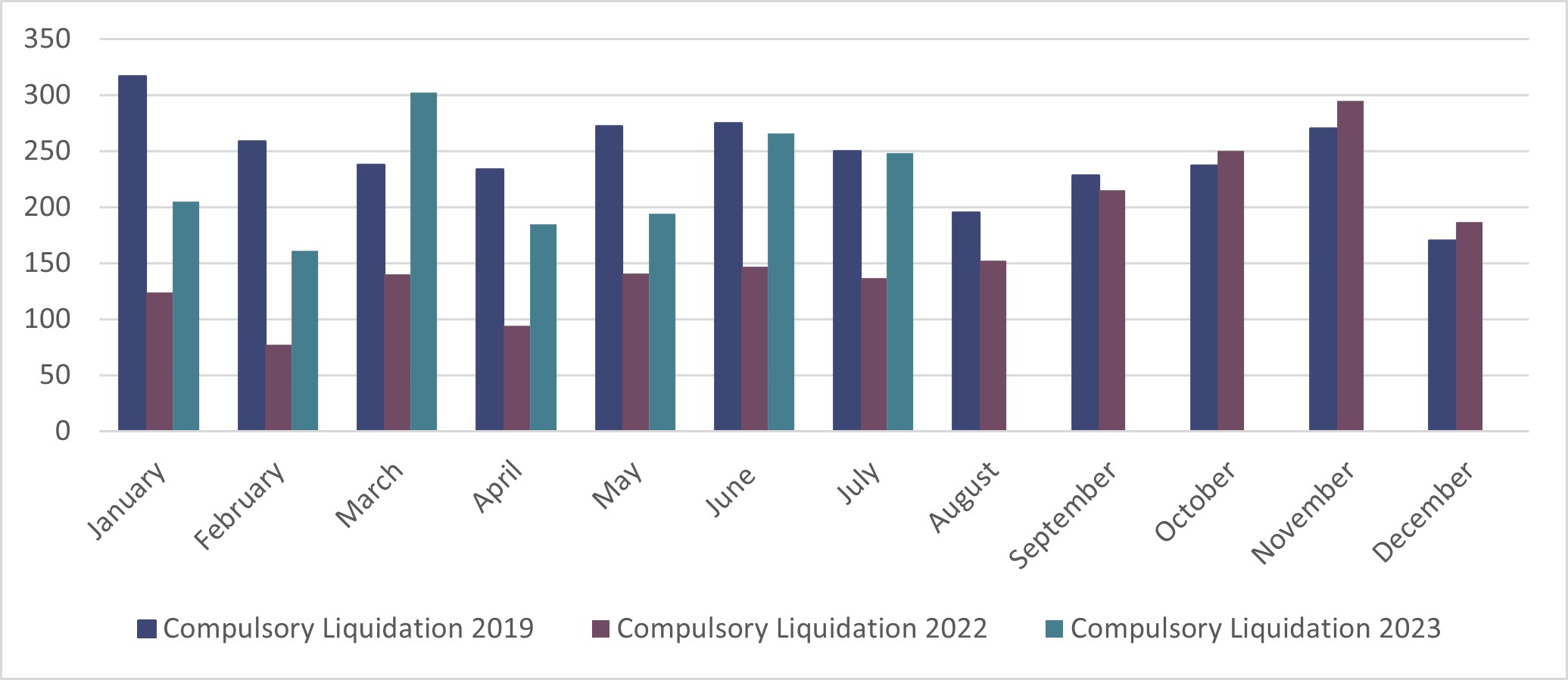

Compulsory liquidations (“WUCs”) totalled 248, almost 81% higher than July 2022 and almost the same as July 2019.

There were 124 administration appointments which is 53% higher than July 2022 but 15% lower than pre-pandemic levels.

There were 19 CVAs in July 2023, almost 3 times as many as July 2022 but 51% lower than July 2019.

Scotland

In July 2023 there were 97 company insolvencies registered in Scotland, 41% higher than the number in July 2022. This was comprised of 44 compulsory liquidations, 51 CVLs and two administrations. There were no receivership appointments or CVAs.

Northern Ireland

In July 2023 there were 13 company insolvencies registered in Northern Ireland, 7% lower than July 2022. This was comprised of eight CVLs, three compulsory liquidations and two CVAs. There were no administrations or receivership appointments.

Personal Insolvencies

England and Wales

Personal insolvency numbers remain on a slow upward curve, as interest rates remain high, and the cost-of-living crisis continues to take effect. Personal insolvencies are almost certain to continue this trend in the second half of 2023 but remain quite volatile month to month.

There were 7,794 Breathing Space (BS) applications in July, against the usual monthly average of around 5,900. This trend might be a significant indicator of things to come.

With clamping down on poor advice and better signposting by the regulated debt advice sector, we expect the BS monthly figure to show a continued steady upward trend. As BS is merely a pause in the debt settlement process, it would not be surprising to also see the DRO, bankruptcy and IVA numbers rise once the BS period expires for these individuals.

July’s Mental Health BS application figure of 134, given the stringent entry criteria, is another significant indicator as to the nation’s wider mental health debt crisis.

There were 5,659 Individual Voluntary Arrangements (IVA’s) on average in the 3-month period to July, which is significantly lower than the 3 month period ending July 2022.

The FCA have banned fees being paid to debt packaging companies, with the impact on IVAs already taking effect. There were 4,981 registered IVA’s in July against 5,156 in June. It will be interesting to see whether this ban, coupled with the increased BS applications continue to drive the IVA figures downwards in the coming months as better, regulated advice begins to take effect.

In 2019, there were 2,289 Debt Relief Orders (DRO’s) a month on average, and following the changes in entry criteria from June 2021, surprisingly they have only averaged around 2,000 per month. The June figure of 2,667 might suggest an uptick in DRO’s.

A current DRO would have previously been a no-asset bankruptcy and therefore, the record low bankruptcy numbers of 2021/22 were of no real surprise. The average monthly bankruptcy numbers in 2019 were 1,395, made up of 1,134 debtor’s applications and 261 creditor petitions.

The stark decrease from that period to the current numbers is clear against the last 12-month averages of 578 bankruptcies, made up of an average of 468 debtor’s applications and 110 creditor petitions per month.

In July, there were 620 bankruptcies, against a 2022 average of 557 per month. We expect the bankruptcy numbers to steadily pick up, showing a more marked increase in the second half of the year.

Bankruptcy petitions will undoubtedly have to be issued by creditors to recover debts incurred during and since the pandemic, as a result of current economic pressures. In July, there were 125 creditors’ petitions, which is slightly up on the preceding 12 months’ average.

We expect to see creditor-driven bankruptcies begin to steadily increase further in the second half of 2023, led by HMRC in the recovery of unpaid tax liabilities. The volume of bankruptcy petitions will be driven by resource availability at HMRC, and by the ability of the Court system to manage them.

Northern Ireland

In July 2023 there were 108 individual insolvencies in Northern Ireland, 33% lower than in July 2022. This consisted of 83 IVAs, 16 DROs and nine bankruptcies.