European Insurers' IFRS 9 Benchmark Study

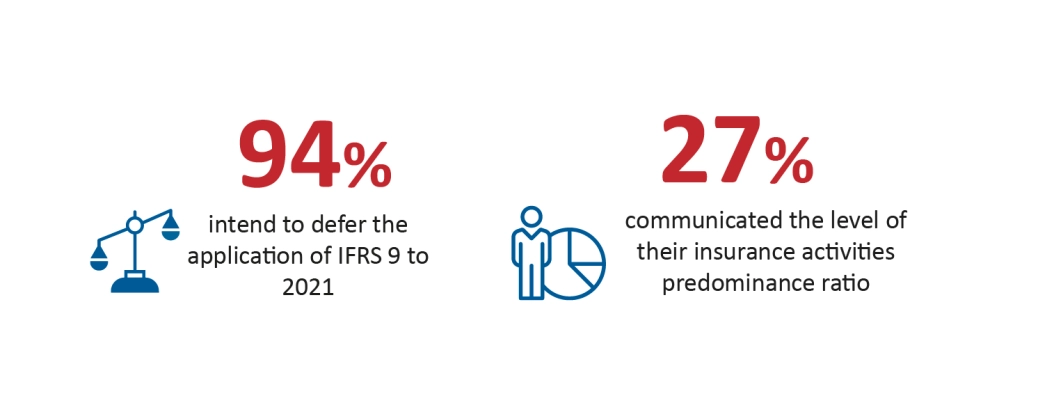

The new standard IFRS 9 on financial instruments has been effective starting 1st January 2018 for most entities but insurance groups have the possibility to defer its application to 2021, the year when the new standard IFRS 17 on insurance contracts will enter into force.

IFRS 9 introduces numerous changes (Phase 1/ classification, Phase 2/ impairment, Phase 3/ hedge accounting, disclosures) and its implementation is complex.

We chose to study the 2017 year-end financial reports of 16 European insurance and reinsurance Groups with the aim of identifying trends, progress and the impact they expect on their financial statements when first applying IFRS 9, and sources of these impacts.

Our Sample

We also had a look at a sample of European bank insurers to see whether they are planning to defer the application of IFRS 9 for their insurance activities.

Our Findings regarding (re)insurers

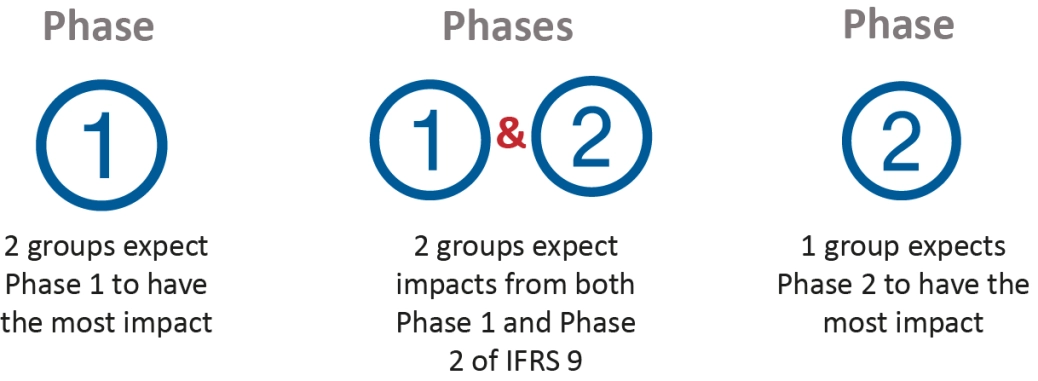

Impact of Different Phases

We have also analysed the expected IFRS 9 impacts by phases that (re)insurers had opted for deferral to 2021. Among the 5 groups distinguishing between the impacts of different phases* of IFRS 9, the main findings are as follows:

*Phase 1 of the standard introduced new requirements for the classification and measurement of financial instruments;

Phase 2 of the standard introduced new impairment principles;

Phase 3 of the standard introduced new rules for hedge accounting.