Mazars 2024-2025 Federal Budget tax & superannuation brief

Described as a “responsible Budget that helps people under pressure today”, the Treasurer has forecast a second consecutive surplus of $9.3 billion. The main priorities of the government, as reflected in the Budget, are helping with the cost of living, building more housing, investing in skills and education, strengthening Medicare and responsible economic management to help fight inflation.

There were very few surprises from a tax perspective with key measures having already been announced. Unfortunately, its another budget with no real tax reform.

The key tax measures announced in the Budget include extending the $20,000 instant asset write-off for eligible businesses by 12 months until 30 June 2025, introducing tax incentives for hydrogen production and critical minerals production, strengthening foreign resident CGT rules and penalising multinationals that seek to avoid paying Australian royalty withholding tax.

The Budget also includes various amendments to previously announced measures, as well as a number of income tax measures that have already been enacted prior to the Budget announcement, including:

- the revised stage 3 personal income tax cuts (enacted by the Treasury Laws Amendment (Cost of Living Tax Cuts) Act 2024 (Act No 3 of 2024)), and

- Medicare levy and surcharge threshold changes (enacted by the Treasury Laws Amendment (Cost of Living—Medicare Levy) Act 2024 (Act No 4 of 2024)).

The government anticipates that the tax measures put forward will collectively improve the Budget position by $3.1 billion over a 5-year period to 2027–28.

The full Budget papers are available at www.budget.gov.au and the Treasury ministers’ media releases are available at ministers.treasury.gov.au.

The tax, superannuation and social security highlights are set out below.

Read ahead:

Individuals

Income tax

Stage 3 tax cuts

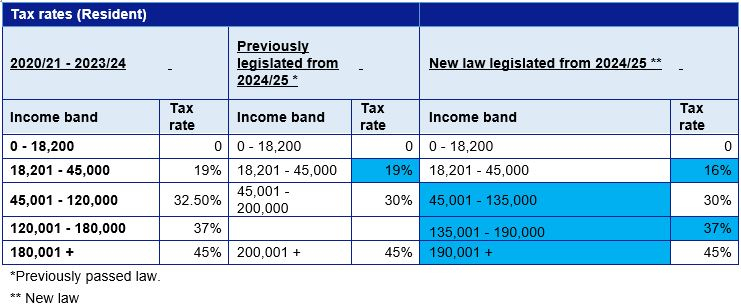

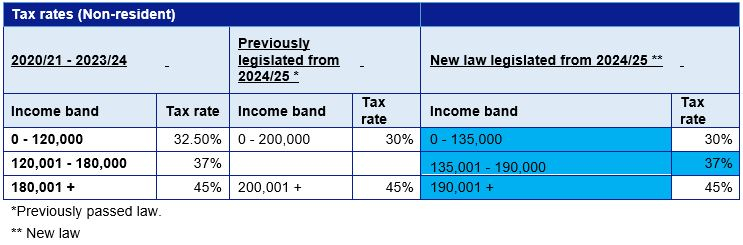

Already announced and legislated are the changes to the ‘Stage 3’ tax cuts to apply from 1 July 2024.

Rather than high income earners on more than $200,000 receiving $9,075 of tax benefit as was previously legislated, the tax cuts have been reduced to a maximum benefit of $4,529 for those taxpayers. The Treasurer advised the average worker will receive tax relief of $36 per week.

The changes now legislated include:

- Lowering the first tax rate on incomes between $18,200 and $45,000 from 19% to 16%;

- Changing the $45,001 - $200,000 30% tax band to stop at $135,000;

- Reintroducing (continuing) the 37% band from $135,001 to $190,000;

- 45% tax rate above $190,000 (legislated $200,000); and

- Increase in the Medicare Levy threshold to $26,000.

Energy Relief Payments for Households

While not a taxation measure, the Government has announced a $300 per household energy relief measure. This will be applied as a direct credit in quarterly instalments to electricity bills. As this is not means tested, some speculate as whether it could be viewed as compensation for high income earners for the reduction in income tax cuts.

Small businesses will also be eligible for a $325 annual electricity rebate.

Foreign resident CGT regime to be strengthened

The foreign resident CGT regime will be strengthened for CGT events that occur on or after 1 July 2025. In respect of such CGT events, the amendments will:

- clarify and broaden the types of assets that foreign residents are subject to CGT on;

- change the point-in-time principal asset test to a 365-day testing period; and

- require foreign residents disposing of shares and other membership interests exceeding $20 million in value to notify the ATO, prior to the transaction being executed. This new ATO notification process will improve oversight and compliance with the foreign resident CGT withholding rules, where a vendor self-assesses their sale as not being taxable real property.

This measure will ensure that Australia can tax foreign residents on direct and indirect sales of assets with a close economic connection to Australian land, more in line with the existing tax treatment applying to Australian residents. It will also align Australia’s taxation of foreign resident capital gains more closely with OECD standards and international best practice.

Tax administration

Statutory discretion for ATO to deal with tax refunds and debts on hold

The Commissioner of Taxation will be given a discretion to not use a taxpayer’s refund to offset old tax debts where that debt had been put on hold before 1 January 2017. The tax law will be amended to provide for this ATO discretion which will apply to individuals, small businesses and not-for-profits. The discretion will maintain the ATO’s current administrative approach to such debts.

Student loans indexation reform

Indexation of the Higher Education Loan Program (and other student loans) debt will be limited to the lower of either the Consumer Price Index or the Wage Price Index, effective from 1 June 2023, subject to the passage of legislation. The measure will apply retrospectively.

Data matching program for migrant workers income and employment

A pilot program matching income and employment data will be conducted between the Department of Home Affairs and the ATO to mitigate the exploitation of migrant workers and abuse of Australia’s labour market and migration system. This measure forms part of broader reforms to the migration system.

Strengthening ATO’s ability to combat fraud and extension of compliance programs

The ATO will be provided additional funding to continue various compliance programs. The current ATO Personal Income Tax Compliance Program will be extended for another year from 1 July 2027 to enable the ATO to continue its focus on emerging risks to the tax system. The Shadow Economy Compliance Program and the Tax Avoidance Taskforce will be extended for 2 years from 1 July 2026.

Funding will be provided to the ATO to improve its detection of tax and superannuation fraud, including to upgrade its information and communications technologies to be able to identify and block suspicious activity in real time. A new compliance task force will also be established to recover lost revenue and block attempts to obtain refunds fraudulently. Funding will also be provided to improve ATO’s management and governance of its counter-fraud activities.

The ATO will have more leeway to delay paying Business Activity Statement (BAS) refunds under a fraud prevention measure. Under the existing rules, the ATO is required to notify a taxpayer within 14 days of BAS lodgement if it intends to retain a BAS refund for further investigation. The ATO’s mandatory notification period for BAS refund retention will now be increased to 30 days. While the measure is directed towards stopping fraud, it can be expected that many legitimate GST credit and BAS refund claimants will have their BAS refunds delayed while an ATO review is undertaken. Where legitimate refunds are retained for more than 14 days, the current requirement for the ATO to pay interest to the taxpayer will remain. Be that as it may, the potential for refund delays will be disappointing news for three sectors being:

- Recurring net credit claimers – businesses whose supplies are typically GST-free, for example, health professionals and exporters

- Start-ups – whose expenses exceed income in their first 1-2 years of operation, and

- High value asset acquirers – entities acquiring taxable property, businesses or other assets resulting in one-off large refund claims.

Businesses

Income tax

Small business depreciation — instant asset write-off threshold of $20,000 extended to 2024–25

The instant asset write-off threshold of $20,000 for small businesses applying the simplified depreciation rules will again be extended for 12 months until 30 June 2025. This has been popular in the past, so it has been extended yet again.

Small businesses (aggregated annual turnover less than $10 million) may choose to calculate capital allowances for depreciating assets under a simplified regime in Subdiv 328-D of ITAA 1997. Under these simplified depreciation rules, an immediate write-off applies for low-cost depreciating assets. The measure will apply a $20,000 threshold for the immediate write-off, applicable to eligible assets costing less than $20,000 that are first used or installed ready for use by 30 June 2025.

Assets valued at $20,000 or more (which cannot be immediately deducted) can continue to be placed into the small business simplified depreciation pool and depreciated at 15% in the first income year and 30% each income year thereafter. The provisions that prevent small businesses from re-entering the simplified depreciation regime for 5 years if they opt-out will also continue to be suspended until 30 June 2025.

The measure extends a 2023–24 Budget measure to increase the instant asset write-off threshold to $20,000 for the 2023–24 income year. A Bill containing amendments to increase the instant asset write-off threshold for 2023–24 is currently before parliament. The Bill was amended by the Senate to increase the instant asset write-off threshold for 2023–24 to $30,000 and extend access to the instant asset write-off to entities that are not small business entities but would be if the aggregated turnover threshold were $50 million.[GC1]

New critical minerals production tax incentive

A critical minerals production tax incentive will be available from 2027–28 to 2040–41 to support downstream refining and processing of Australia’s 31 critical minerals to improve supply chain resilience.

In total, an estimated $7.1 billion will be spent over 11 years from 2023–24 to support refining and processing of critical minerals, as part of the government’s Future Made in Australia initiative to make Australia a renewable energy superpower. This includes:

- the above critical minerals productive tax incentive, at an estimated cost of $7.0 billion over 11 years from 2023–24;

- $10.2 million in 2024–25 for pre-feasibility studies for critical mineral common-user processing facilities, in partnership with state and territory governments; and

- the tax incentive will come in the form of a refundable tax offset of 10% of the cost of processing 31 critical minerals listed in Australia.

To facilitate the production of critical minerals, the Government will also provide $566.1 million for Geoscience Australia to map Australia’s national groundwater systems and resource endowments to increase industry investment and identify potential discoveries of all current critical minerals and strategic materials.

New hydrogen production tax incentive

A hydrogen production tax incentive will be available from 2027–28 to 2040–41 to producers of renewable hydrogen to support the growth of a competitive hydrogen industry and Australia’s decarbonisation. The incentive will be at the rate of $2 per kilogram of renewable hydrogen produced for up to 10 years for projects that reach final investment decision by 2030.

In total, an estimated $8.0 billion will be spent over 10 years from 2024–25 to support the production of renewable hydrogen, as part of the government’s Future Made in Australia initiative to make Australia a renewable energy superpower. This includes:

- the above hydrogen production tax incentive, at an estimated cost of $6.7 billion over 10 years from 2024–25;

- $1.3 billion over 10 years from 2024–25 for an additional round of the Hydrogen Headstart program to bridge the green premium for early-mover renewable hydrogen projects; and

- $17.1 million over 4 years from 2024–25 (and an additional $2.5 million in 2028–29) to deliver the 2024 National Hydrogen Strategy, including hydrogen infrastructure planning, social license and industry safety training and regulation.

Further changes to film producer tax offset

The minimum length requirements for content and the above-the-line cap of 20% for total qualifying production expenditure for the producer tax offset will be removed.

To be eligible for the producer tax offset, films are currently required to meet minimum length requirements under s 376-65(3)–(5) of ITAA 1997. Different length requirements apply depending on the format of the content.

“Above-the-line” expenditure which can be qualifying production expenditure for the purposes of the producer tax offset is currently capped at 20% of total film expenditure for all films except documentaries under s 376-170(4)(b) of ITAA 1997. Such expenditure includes development expenditure on a film and remuneration provided to the principal director, producers and principal cast associated with a film.

New penalties for large group entities mischaracterising or undervaluing royalty payments

A new penalty will be introduced from 1 July 2026 for taxpayers who are part of a group with more than $1 billion in annual global turnover that are found to have mischaracterised or undervalued royalty payments, to which royalty withholding tax would otherwise apply.

Measure to deny deduction for payments relating to intangibles discontinued

The Labor government’s 2022–23 Budget measure to deny deductions for payments relating to intangibles held in low- or no-tax jurisdictions is being discontinued.

An anti-avoidance rule was proposed in the 2022–23 Budget to prevent significant global entities (SGEs) from claiming tax deductions for payments made directly or indirectly to related parties in relation to intangibles held in low- or no-tax jurisdictions. The integrity issues will instead be addressed through Australia’s implementation of the global and domestic minimum taxes as part of the OECD’s Two Pillar solution to address the tax challenges arising from the digitalisation of the economy under Action 1 of the Base Erosion and Profit Shifting (BEPS) project.

Expansion of Pt IVA general anti-avoidance rule delayed

The government had announced in the 2023–24 Budget that the general anti-avoidance rule would be expanded to capture schemes that result in reduced Australian tax via lower withholding tax rates on income paid to foreign residents. The changes announced also included extending Pt IVA to schemes with a dominant purpose to reduce foreign income tax where the scheme achieved an Australian income tax benefit.

When first announced, the changes were to apply for income years starting on or after 1 July 2024. The changes will now apply for income years commencing on or after assent of enabling legislation, regardless of whether the scheme was entered into before that date.

Income tax exemptions for World Rugby

Further to the measure “Rugby World Cup 2027 (men’s) and Rugby World Cup 2029 (women’s)” announced in the Coalition government’s 2022–23 Budget, income tax exemptions will be provided to World Rugby and/or related entities for income derived in relation to the Rugby World Cup 2027 (men’s) and Rugby World Cup 2029 (women’s) events (RWC events).

The exemptions will apply to income derived in relation to the RWC events for the 2023–24 to 2030–31 income years (inclusive). An exemption will also be provided from interest, dividend and royalty withholding tax liabilities arising from payments relating to RWC events.

Excise and customs duty

Removal of nuisance tariffs

Tariffs identified as a nuisance across a range of imported goods will be removed from 1 July 2024.

The measure will permanently set to “free” the rate of duty in sch 3 and sch 4A–15 of the Customs Tariff Act 1995 on 457 tariff lines. These tariffs had been identified as a nuisance to Australian businesses, imposing unnecessary administrative costs and compliance burdens. Tariffs that will be removed relate to a range of imported goods, including household necessities such as toothbrushes, tools, fridges, dishwashers and clothing.

A consultation paper for this measure was released on 11 March 2024.

Superannuation

From a superannuation perspective, the 2024-25 Federal Budget was reminiscent of the previous year with minimal announcements and no major changes as the focus remained on cost of living pressures within Australia.

Super to be paid on government-funded paid parental leave

Superannuation will be paid on government-funded paid parental leave (PPL) for births or adoptions on or after 1 July 2025. Eligible parents will receive an additional payment based on the superannuation guarantee (12% of their PPL payments), as a contribution to their superannuation fund.

Payments will be made annually to individuals’ superannuation funds from 1 July 2026.

This will reduce the impact on individuals’ retirement benefits when taking a career break to have children and help close the gender gap which continues to be an issue in superannuation.

Division 296 – Administrative costs for Commonwealth defined benefit schemes

Additional funding has been allocated to the Commonwealth Superannuation Corporation and the Department of Finance to help meet the costs associated with implementing the 2023–24 “Better Targeted Superannuation Concessions” Budget measure for members of the Commonwealth defined benefit superannuation schemes. This measure, called Division 296, is the additional tax on individuals with greater than $3 million in superannuation.

These costs, to be borne by taxpayers, is budgeted to be $9.2 million over four years from 2024–25 (and $1.1 million per year ongoing). This is another example of the administrative burden and cost the complicated Division 296 tax is placing on taxpayers.

Payday super

To bolster the Productivity, Education and Training Fund, the Government is allocating $60m over four years to which will also assist workplaces with the introduction of payday superannuation.

Payday superannuation was previously announced in the 2023-24 Federal Budget and will require employers to pay their employees’ superannuation guarantee requirements at the same time as their salary and wages from 1 July 2026. Currently this is only required to be paid on a quarterly basis.

Freezing of social security deeming rates – extended

The Government has announced that it will extend the current freeze on the Social Security deeming rates at their current levels for a further 12 months – until 30 June 2025.

This will assist Age Pensioners and other income support recipients who rely on income from deemed financial investments, as well as their payment, to manage cost of living pressures.

If you have any questions please speak to your usual Mazars adviser or contact our Tax and Superannuation specialists via the form or contact details below:

| Brisbane – +61 7 3218 3900 | Melbourne – +61 3 9252 0800 | Sydney – +61 2 9922 1166 |

Jamie Towers Clive Todd | Evan Beissel Michael Jones | Gaibrielle Cleary Jeremy Mortlock |

Published: 15/05/24

All rights reserved. This publication in whole or in part may not be reproduced, distributed or used in any manner whatsoever without the express prior and written consent of Mazars, except for the use of brief quotations in the press, in social media or in another communication tool, as long as Mazars and the source of the publication are duly mentioned. In all cases, Mazars’ intellectual property rights are protected and the Mazars Group shall not be liable for any use of this publication by third parties, either with or without Mazars’ prior authorisation. Also please note that this publication is intended to provide a general summary and should not be relied upon as a substitute for personal advice. Content is accurate as at the date published.