Thailand payroll services

Our highly trained team of payroll professionals is led by Rattanawan Sriwichian who has worked for Mazars for over 15 years. The core of the payroll team have worked together for more than 10 years. We believe that our team of payroll experts who have a strong focus on client service enable our clients to navigate the requirements and complexities of Thai payroll.

Our payroll expertise:

- Excellent communication in Thai, English, Japanese and Korean

- Working with regional and global HR functions located outside of Thailand

- Complex payroll requirements such as non-Thai Baht salaries and tax on tax calculations (where tax is borne by the employer)

- Processing payroll with time and attendance data

- International mobility including hypo-tax, shadow payroll or home country reporting

- Working within tight deadlines

- Providing a one-stop service including accounting, tax compliance and work permit and visa services

Implementation

Mazars has significant experience in the implementation of payroll. During this critical period, our responsibilities are:

- Set up the employee database

- Set-up procedures

- Test the payroll process

- Eliminate errors and incorrect settings

- Perform a sample test (if required)

The transition process will be based on a detailed transition plan that would be agreed with our client.

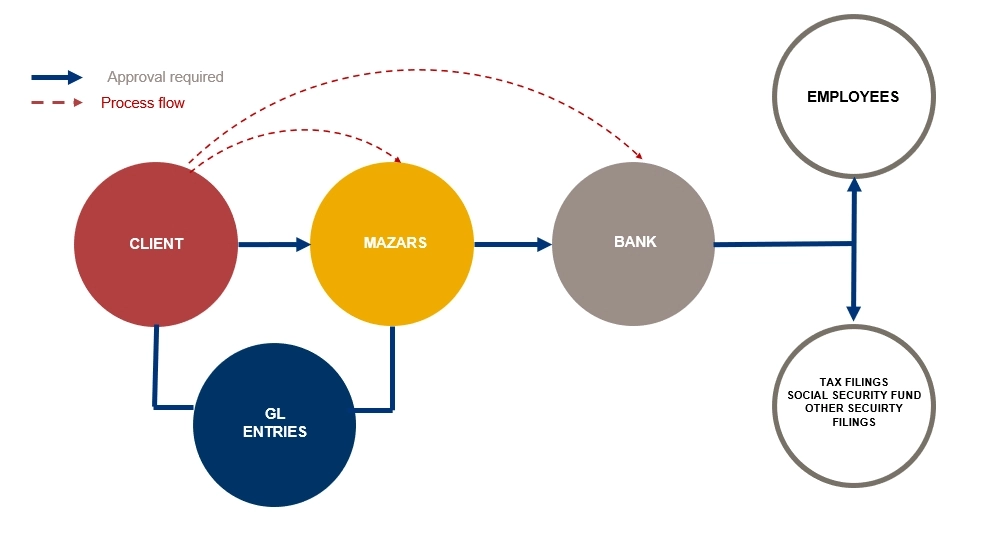

Monthly payroll processing

Mazars will assign each client to a dedicated team led by one of our experienced payroll managers.

- Employee and payroll data to be maintained in HReasily or our client’s own HRM system.

- Key information to be provided are the monthly variations including leavers and joiners.

- Mazars process the monthly payroll data.

- Payroll workflows and timelines are agreed annually in advance and are the backbone to ensuring that your staff are paid correctly and on time every month.

- All outputs including pay slips, statutory returns and bank files are generated in HReasily.

Reporting

Monthly payroll report

- Showing, for each employee, the following: basic salary; additional income; deductions; withholding tax payable; employees SSF contribution; Provident Fund contribution; net salary payable.

- Details of the staff that have resigned, terminated or joined client that month.

- Variance report showing the current and previous month.

Confidential personalised payslips

- Employees can access by mobile or through a web- based platform – HReasily. Carbon copies can also be printed and distributed.

Payroll withholding tax form (PND-1)

- To be generated electronically and submitted by Mazars on behalf of the client.

Social Security Fund form (SPS1-10)

- Recommended to apply for Social Security Fund e-filing

Social Security Fund – SPS series forms (SPS1-03, 1-03/1 and 6-09)

- Optional service to handle the administrative tasks around leavers and joinders and changes to the client’s particulars.

Provident fund

- Employers and Employees’ contributions will be summarized and submitted to the provident fund management company.

- Mazars can provide Provident Fund administration services.

Withholding Tax Certificate (50 Tawi)

- Prepared for departing employees.

Other

- Prepare payroll accounting journal entries.

- Inform clients of any changes to or new regulations that impact payroll processing.

On a annual basis:

- Workmen’s Compensation Fund Forms (Kor Tor 26 Kor and Kor Tor 20 Kor)

- Employee Withholding Tax Certificate (50 Tawi)

- PND-1 Annual Summary Form (PND-1 Kor)

- Personal income tax returns (PND-91) for expatriate employees only

Quality control

Mazars have documents all payroll workflows which are tied into detailed schedules that identify potential risks during all aspects of the payroll processing along with the controls and processes in place to mitigate those risks.

These controls and processes cover:

- New client implementation

- Monthly payroll processing

- Payment processing

- Leavers and joiners

- Year-end processing

- General controls

- Client approval