Forvis Mazars Payroll Flash News - August 2024 (Vol.1)

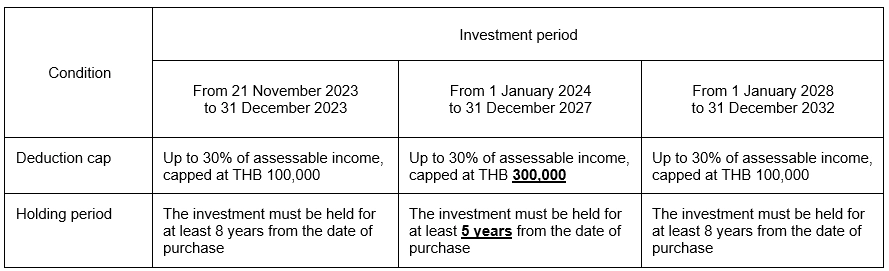

On 30 July 2024, the Cabinet approved a draft ministerial regulation proposed by the Ministry of Finance to increase the tax deduction for individual taxpayers investing in Thai mutual funds for environmental, social and corporate governance (“ESG”) during the period from 1 January 2024 to 31 December 2027, as detailed below.

- Increased deduction amount: Investors can now deduct up to 30% of their annual taxable income, up to THB 300,000, which was increased from the previous limit of THB 100,000.

- Reduced holding period: The holding period to qualify for tax allowances and exemptions on capital gains from purchasing investment units has been reduced from 8 years to 5 years.

For example, if you invested in a Thai ESG mutual fund on 25 December 2023, you are required to hold the investment for eight years (until 25 December 2031) and can then sell the units starting from 26 December 2031. If you sell the units before reaching the eight-year mark, you will have to recalculate your personal income tax from the first year that you utilized the deduction allowance and pay additional tax, together with a monthly surcharge of 1.5% of the tax shortfall.

However, if you invest in Thai ESG units on 25 December 2024, you only need to hold the investment for five years (until 25 December 2029), and can then sell the units from 26 December 2029 onwards.

Source (in Thai):