Transfer pricing audits from the perspective of the Financial Administration

Read the press release in Czech HERE.

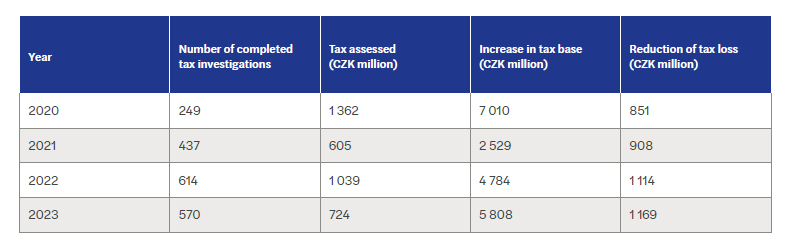

Both the statement of the Financial administration itself and the overview of the results of the transfer pricing audits stated below clearly show the importance of this topic and its potential risk for companies that are part of multinational groups but do not pay sufficient attention to this topic.

Although it might seem from the press release that the above mentioned figures are exclusively related to collusive practices of multinational companies aimed at tax optimization and shifting profits out of the Czech Republic, according to our experience, a significant part of these withholdings concerns companies that trade with related parties without collusive intentions and without any effort to deliberately reduce the tax base in the Czech Republic. We often encounter situations where the taxpayer lives under the assumption that it is trading with related parties on terms that make economic and business sense, only to find out during the tax audit that the Financial Administrator has a completely different view of the whole matter because all transfer pricing principles have not been reflected and taken into account.

Very often these situations stem from a taxpayer’s misjudgement of its own functional profile, in a situation where the taxpayer bears risks over which another group company has control through execution of key decision-making powers (which is contrary to the arm’s length principle). As we have already commented in more detail in our Tax Alert 1/2022 (available HERE) the issue of miss assessment of the functional profile may not always be related only to related party transactions, but it also applies to situations where the transaction is carried out with an independent party, however on the basis of terms and conditions negotiated by another group company.

Another challenge in transfer pricing is often not the setting of the transfer prices themselves (their amount), but above all the subsequent demonstration and justification required in the context of a tax audit. The Financial Administrator very often apply a very rigid and formalistic approach during the audit, requiring the submission of impeccable and extensive evidence, while at the same time often trying to question its credibility and conclusiveness on the basis of the slightest inaccuracies or inconsistencies. Thus, the taxpayer often fails to meet its burden of proof, which leads to additional tax assessment not only due to an adjustment of the transfer prices by the Financial Administrator, but in the case of management (and other) services, very often also reclassification of related costs as tax non-deductible.

Although the phenomenon of advertising services and back-licensing of intangible assets, mentioned by the Financial Administrator, is among other risk areas, in our experience it is again not a frequent and main topic of tax audits, where the mentioned functional profile and demonstration of management services received play a major role. Nevertheless, the area of intangible assets should not be neglected in the context of the Tax Administration’s statement and we recommend to examine whether each member of the group is remunerated for its contribution to the functions related to the development, improvement, maintenance, protection and use of the intangible asset.

We also recommend paying attention to other aspects and pitfalls of transfer pricing that we have previously described in Mazars Tax View 6/2023 (available HERE), which in our experience are still not given sufficient attention by many taxpayers.

Our specialists are ready to provide you with additional information.

Author: Ivo Žilka, Tax Manager

Contact