The future of branch banking in the Philippines

For many years the branch has been at the heart of banking operations across the world, simultaneously playing the role of service delivery hub, sales outlet, processing centre and unit of account. In more recent times the branch has been somewhat upstaged by digital channels and the promise to revolutionise everything from customer experience through to the economics of distribution. So what are the implications of this digital revolution on branch banking and how should the industry adapt?

We believe that each bank needs to answer two key questions:

- What role should the branch play within their organisation?

- What organisational changes and investments are required to enable and support this new role?

The role of the branch

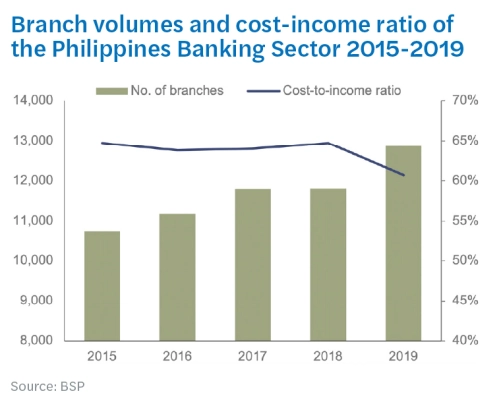

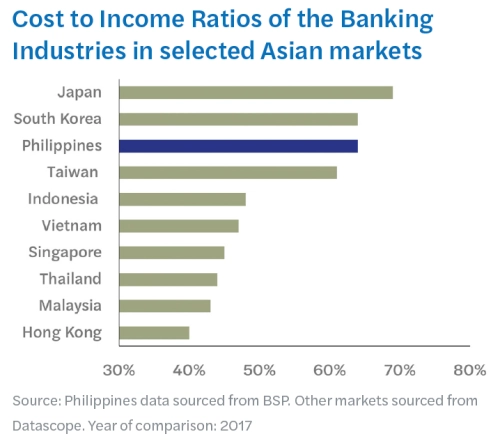

In countries with mature banking industries branch numbers have diminished in recent years as competitors merge and consolidate operations, and as activity is displaced to digital channels. Meanwhile in the relatively under-banked Philippines, branch numbers have continued to grow as banks expand their physical presence and reach out to a young and growing population widely dispersed across an archipelago. However, this investment comes at a cost and is a major factor causing the cost-income ratio of the Philippine banking sector to be significantly higher than that of other countries in the Asia-Pacific Region.

We believe that banks now need to make an important strategic decision and determine exactly what the role

of the branch should be for their organisation. The answer to that question will determine to what extent future

expansion (or contraction) of the network is required, how branches should be configured and resourced, and

how they should be managed organisationally.

Whilst each bank should view the question in relation to their own competitive strengths, there are some

commonalities that all banks can benefit from adopting:

- an increased focus on sales and service. The branch remains the key channel for interpersonal contact and a conducive place for activities such as explaining products or dealing with complex concerns. Focusing a higher proportion of branch activity on these aspects should increase customer satisfaction and profitability.

- an increased focus on customer acquisition and community engagement. Regardless of whether located in urban or rural locations, branches are rooted in communities and can play a vital role in local life. By engaging in community outreach activities banks can simultaneously support local people, build brand awareness and loyalty, and drive new customer acquisition.

- a showroom for the entire bank. Historically the branch was the bank. As telephony and digital banking evolved these channels have in many cases become separated from the branch causing dislocations in the overall customer experience. This can be addressed by reconfiguring the role of the branch to be a physical showroom for the whole bank. Customers coming into the branch should receive guidance on how to use digital banking and should experience seamlessly integrated services such as on-the-spot digital activation.

- product neutrality and holistic customer servicing. In the Philippines Branch Banking is synonymous with deposit gathering. Whilst the branch remains a vital ingredient in deposit gathering this structural linkage can be detrimental, hindering the growth of digital deposit gathering and sales and service of a wider range of products. The branch of the future should view the customer holistically and be product neutral.

Enabling the modern branch

In order to facilitate the transformation of the branch a number of wider organisational changes need to be made. These include:

- Investment in digital capabilities to support migration of routine transactions out of the branch

- Increased use of technology and analytics within the branch environment

- Changes in organisational structure

A key ingredient in the process of transforming the branch is the need to create capacity by migrating low-touch routine transactions to other channels. Forcing customers against their will to use other channels because they are cheaper is unlikely to win many favours. Instead, banks should consciously strive to deliver superior digital alternatives that customers actually want to use. Once these are in place customer education and “nudge” strategies can be used to encourage migration. Taking just one example, once provided with a digital cheque deposit facility and shown how to use it, few customers would prefer to stand in a long teller line to conduct the same transaction.

Technology and analytics should also be applied directly to the branch environment, enhancing effectiveness and customer experience across a range of areas including:

- End-to-end integrated servicing – e.g. picking up applications started online for completion in branch

- Digital onboarding – introducing customers to digital channels

- Holistic customer understanding – e.g. understanding product holdings, customer profitability and propensity to buy

- Productivity measurement – understanding branch performance calibrated against norms appropriate to the catchment area and customer base

FOCUS AREA – Example applications of analytics in the branch environment

With the role of the branch changing, its place in the organisational structure must adjust accordingly. Branch banking should evolve from a self-contained business unit to an integral and interlinked element of the distribution structure alongside the complementary telephony and digital channels. Product management and marketing activities for deposits should be removed from branch banking and passed to a central function with the technical skills to manage this important area and the ability to engage and service customers through the full range of available channels.

Staffing requirements must change too. With regard to leadership, people management skills will remain as important as ever, but will increasingly need to be complemented with the ability to leverage technology and analytics. The historic ‘people-led’ focus of the branch and ‘technology and data-led’ focus of digital will become blurred as both channels mature and customer experiences draw on the strength of both. Leaders will need to constantly update their skillsets or risk being left behind. Likewise, branch staff will need to be increasingly tech-savvy to educate customers on the bank’s digital capabilities and must also upgrade their skillset as the requirements of their roles acquire a sharper commercial focus.

Conclusion

For all the promise of digital, we believe the branch is here to stay for the foreseeable future. Indeed, the experiences of the pandemic have simultaneously proven the benefits of investments in digital and also the real human longing for the authentic in-person experience. The branch of the future will be less focused on processing routine tasks, but instead much more sales and service-oriented and increasingly supported by technology and analytics.

Download a copy of this article below.