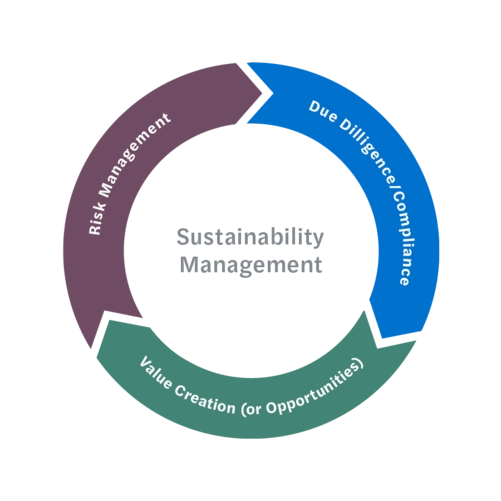

Due diligence, risk and opportunity management

Organizations need to embed sustainability factors to be risk resilient while creating value, both internally and externally, positively impacting people, the planet and the economy. This process involves a thorough ESG due diligence, addressing social, economic and environmental risks to safeguard stability and growth. Furthermore, companies can harness the opportunities afforded by sustainability and translate them into competitive advantage.

Due diligence

Due diligence to meet stakeholders’ expectations and comply with new ESG regulations. Inaction could have negative ramifications: from a company’s impact on sustainability and for ESG impacts on the organization (Double Materiality).

Risk management

The risks of not implementing sustainable business strategies are greater than ever. There are financial risks from sustainability factors – e.g., climate-related physical and transition risks – that may impact enterprise value in addition to non-financial risks if a company negatively impacts people, the economy and/or the environment.

Value creation opportunity

A sustainability journey’s scope extends beyond due diligence, compliance and risk mitigation. It’s also about identifying and securing value creation opportunities linked to the three dimensions of sustainability.

Companies face various ESG challenges, for example to:

- Effectively identify and manage ESG risks

- Achieve compliance in an ever-evolving regulatory landscape

- Create value from ESG areas

- Integrate sustainability into the organization’s core

How Mazars help

Mazars has extensive expertise in helping companies with both financial and non-financial due diligence, risks and value creation. We can help you:

|

Contact