The financial communication of insurance groups: focus on Solvency II

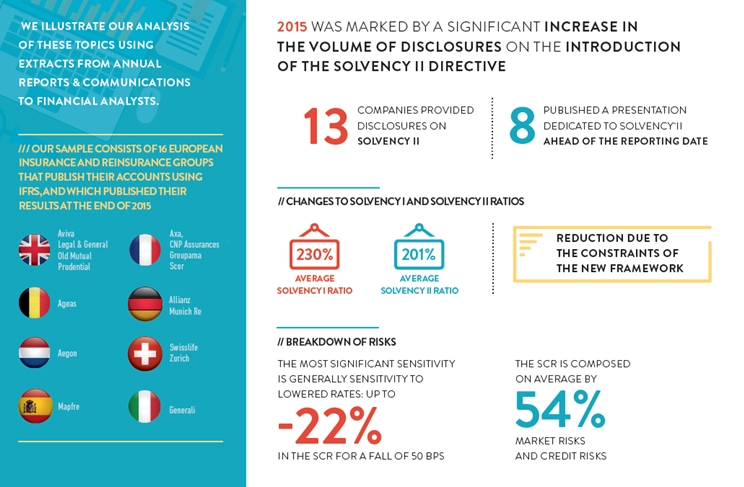

Over the years, financial communication has become an essential aspect of promoting the activities of large insurance groups. The exercise has particular salience this year with the arrival of the European Solvency II Directive, introducing far-reaching changes in the matter of capital requirements and risk management. Against this background, we have taken a closer look at the information available on Solvency II, the major issue in financial communication in 2015.

Communication on Solvency II : 5 key findings

- The introduction of Solvency II has enhanced the financial communication of insurers, both qualitatively and quantitatively;

- Several groups have adapted well to the demands of the new regulatory environment, no doubt due to earlier work to develop their internal models;

- The information on future prospects, capital management and the distribution of dividends could all be improved;

- Financial communication will doubtless be enriched in 2016 with the effective date of the Solvency II Directive, the first SFCR publications, and the full maturity of Own Risk Solvency Assessments (ORSA);

- The future of Embedded Value reporting is something to keep an eye on in the years to come: will convergence with Solvency II be complete, leading to the disappearance of this indicator?