OECD BEPS - The 2015 Final Reports and the next step

OECD BEPS - 2015 Final Reports and the next step

In the next few months, we will see both global impact of the Final Package (via amendments of the OECD Model Tax Treaty, Transfer Pricing Guidelines and the Multilateral Instruments) and unified actions from countries. Moreover, we might see how tax authorities will use the Final package to challenge existing arrangements, transactions and business.

The policy formulation stage of this work will be concluded by the end of this year and further work is expected in the close future.

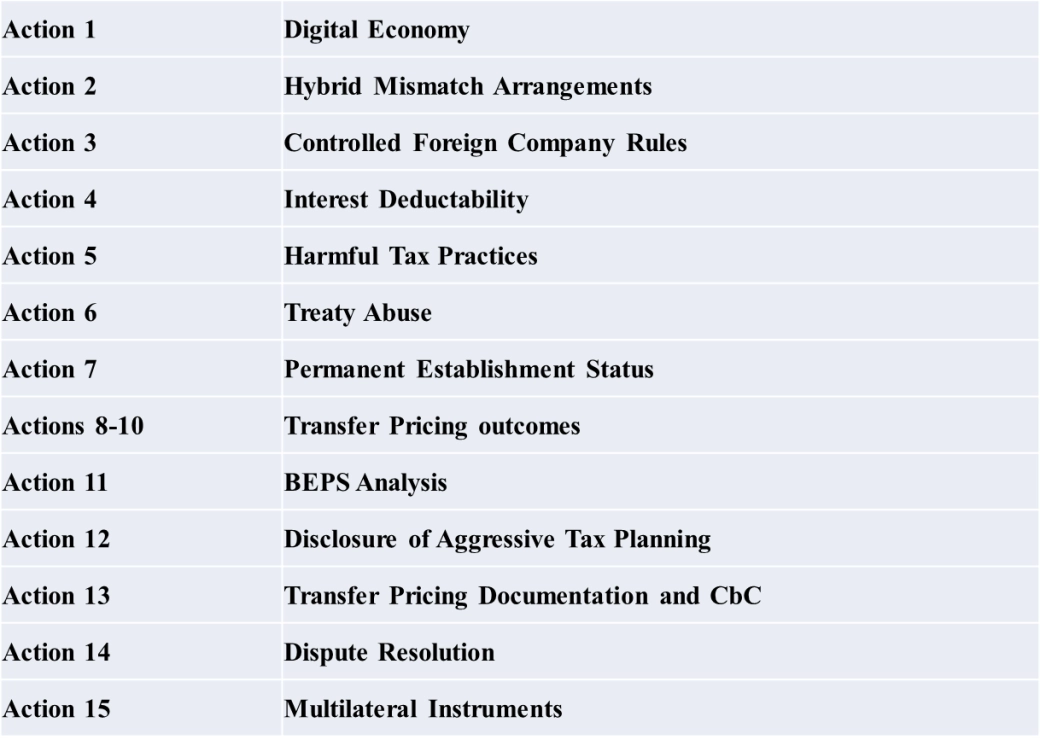

The following blog article analyses the 15 Action Points:

To read the full article, please click here.