Getting ready for OSFI’s Standardized Climate Scenario Exercise (SCSE)

On 16 October 2023, the Office of the Superintendent of Financial Institutions (OSFI) launched a consultation on its draft methodology for the Standardized Climate Scenario Exercise (“SCSE”). The exercise is a follow-up of OSFI’s expectations around climate scenario analysis set out in its Guideline B-15: Climate Risk Management.

The SCSE aims to measure climate risks not captured by traditional risk quantification techniques, such as those relying on historical data. It will assess exposure to climate risks and enhance understanding of how these risks impacts various counterparties and industries. OSFI seeks to achieve the below objectives from the SCSE:

1) Raise awareness and increase understanding of potential exposures to climate change.

2) Support Federally Regulated Financial Institutions (FRFIs) to build their capacity to assess the impact of climate risks and conduct climate scenario exercises.

3) Establish a standardized quantitative assessment of climate-related risks.

The SCSE is limited in scope and is not intended to comprehensively size the risk of climate change to FRFIs. However, this exercise is a foundational step that is expected to inform future exercises.

Scope of SCSE

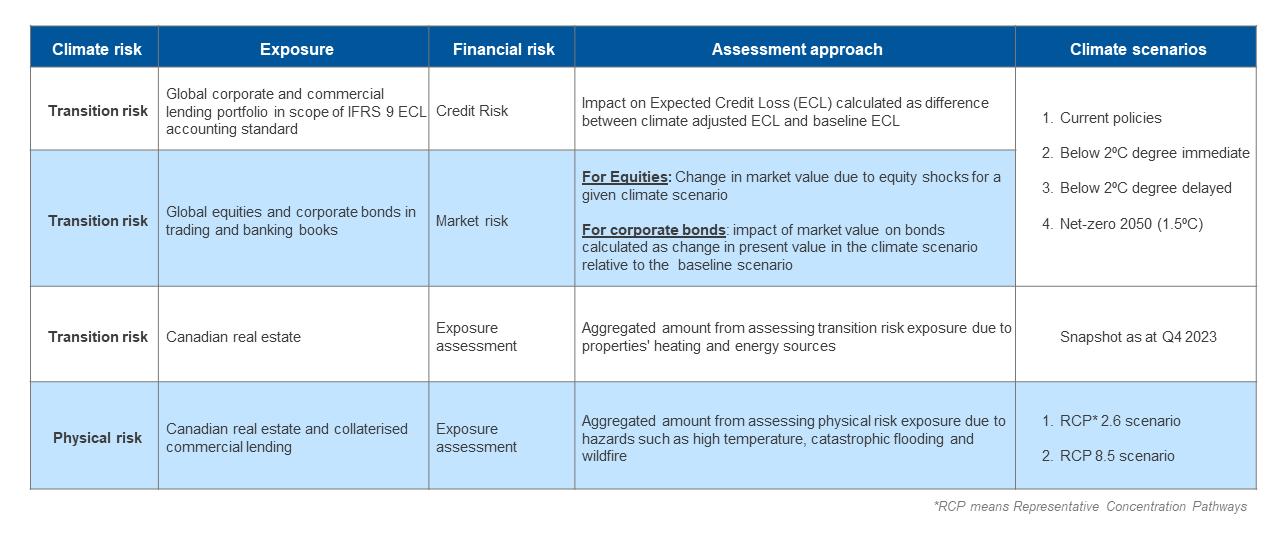

The SCSE will be structured along four independent modules. Overlaps or correlations in risk exposures across the modules would not be considered during this exercise. The table below summarizes the scope of each module.

All FRFIs, except Foreign Bank Branches (FBBs) and Federally Regulated Pension Plans (FRPPs), will be required to submit a completed workbook and questionnaire. FBBs and FRPPs are encouraged to participate in the SCSE.

Next steps

Though the draft methodology from OSFI is subject to change, Financial Institutions (FIs) should be taking steps to adequately prepare for the SCSE. Such actions include:

Sector and exposure classification – FIs should accurately identify in-scope exposures in line with the asset class definition and map counterparties within relevant sectors using North American Industry Classification System (NAICS) codes. FIs should not solely aim for a one-time mapping exercise. They should also consider needed updates to IT systems and processes to ensure consistent alignment. This is vital as the prescribed asset definitions and industry codes would also be used for OSFI’s climate risk returns.

Information on real estate exposures: FIs should gather data on the heating and energy sources of their real estate exposures, identifying where proxies may be necessary. Geocoding of exposures would also be needed to complete the physical risk exposure assessment. For commercial lending exposures, the physical presence for the collateral may not be adequately captured by a single point. Therefore, FIs should map and understand the exposure of underlying assets to different physical hazards. FIs should assess internal data availability and may need to start engaging with their customers to collect necessary information.

Materiality assessment – FIs should conduct a risk identification process to understand how climate risks drivers and transmission channels can significantly impact their business model and strategy across different time horizons. Materiality assessment should be tailored to FI’s risk profile and duly consider vulnerabilities to the sectors, operations and physical locations of the FI and its counterparties. It will enable FRFIs to identify physical hazards and transition elements which are relevant to their business model, strategies, asset portfolios and geographies. This materiality assessment would also be integral in leveraging SCSE outcomes to enhance internal climate scenario analysis and overall climate risk capabilities.

OSFI plans to release a second consultation in Q2 2024 for feedback on their draft technical instructions and workbook. The SCSE is expected to start in fall 2024 and the final report from OSFI should be published in 2025. In addition to preparing for the SCSE launch, FRFIs are encouraged to perform a gap analysis to identify and prioritize their climate risk framework development needs to demonstrate compliance with OSFI’s B15 expectations.